Global Pharmaceutical market is expected to grow from $1.3 trillion in 2022 to $1.9 trillion in 2027 growing at a CAGR of 4.5% (IQVIA Market Prognosis January 2023). Global spending on medicines from 2020 to 2027 is expected to exceed the pre-pandemic outlook, largely due to new spending on COVID-19 vaccines and novel therapeutics, as well as the impact on other therapeutic areas. The use of medicines globally plateaued in 2022 following a significant rebound in 2021 as markets recovered from the pandemic. Spending and volume growth will follow diverging trends by region with larger established markets demonstrating slower growth rates. In contrast, growth markets in Eastern Europe, Asia and Latin America are expected to grow in both volume and spending. Overall volume is projected to grow 1.6% CAGR in days of therapy through 2027, driven by Asia-Pacific, India, Latin America, Africa and the Middle East, and China, all of which are expected to exceed global volume growth. Higher income countries in Western Europe and North America as well as Japan and Eastern Europe are expected to grow at 0.1 to 0.4% through 2027, partly due to their already higher per capita use. Eastern Europe volume growth is also hampered by disruptions from the ongoing Ukraine conflict.

The global generics industry witnessed significant challenges, such as intense price competition, rising costs of raw materials and manufacturing, regulatory uncertainties and supply chain disruptions. Despite these headwinds, the industry also benefited from some positive developments, such as the increasing adoption of biosimilars, the emergence of new markets and segments, innovation in drug delivery systems and formulations, and support from governments and regulators to promote generic competition and access. Looking ahead, the global generics industry is expected to maintain its growth momentum, as the demand for cost-effective therapies continues to rise, especially in emerging markets and for chronic diseases.

Lupin is responding to these trends by investing in its inhalation and injectables portfolio and pipeline. Lupin plans to make these complex areas the future pillars of its business. Lupin has also invested in growing its presence in India and reach more customers and increase its volume growth. In other markets, Lupin is growing faster than the local market by using its global portfolio and resources.

The global generics industry also witnessed significant challenges, such as intense price competition, rising costs of raw materials and manufacturing, regulatory uncertainties and supply chain disruptions. The U.S. market, saw a new wave of price pressure in FY23. Despite these headwinds, the industry also benefited from some positive developments, such as the increasing adoption of biosimilars, the emergence of new markets and segments, the innovation in drug delivery systems and formulations, and the support from governments and regulators to promote generic competition and access. Looking ahead, the global generics industry is expected to maintain its growth momentum, as the demand for affordable medicine continues to rise, especially in emerging markets and for chronic diseases.

Despite the challenges, Lupin has come a long way in FY23 and is strategically poised for sustainable growth in FY24 as we launch products like Tiotropium, Darunavir and others in the U.S. and drive consistent double-digit growth in India business. Lupin remains focused on driving operating margin improvement as its grows our business.

The demand for generic drugs is increasing worldwide due to patent expirations, cost containment efforts, and improved access to affordable healthcare.

There is a growing focus on specialty pharmaceuticals, including biosimilars and specialized formulations, to address complex diseases and meet specific patient needs.

The industry is experiencing significant technological advancements, such as artificial intelligence, big data analytics, and digital health solutions, which are revolutionizing research, development, manufacturing, and patient care.

The pharmaceutical industry continues to operate within a complex regulatory environment, with evolving regulations and increased emphasis on quality standards, patient safety, and intellectual property protection.

Pharmaceutical companies are exploring new markets and opportunities in emerging economies, such as India, China, Brazil, and other regions with expanding middleclass populations and growing healthcare infrastructure.

The industry continues to invest heavily in research and development to discover innovative therapies, improve existing treatments, and address unmet medical needs.

Companies are also expanding their offerings to encompass adjunct services, aligning with a patient-centric and holistic approach. This strategic shift allows for additional growth opportunities, particularly in countries like India.

Pharmaceutical companies are increasingly

adopting sustainable practices, reducing

their environmental impact, and promoting

responsible manufacturing to contribute to a

healthier planet.

These global trends shape the pharmaceutical

industry’s landscape and influence the

strategies and decisions of companies

operating within it.

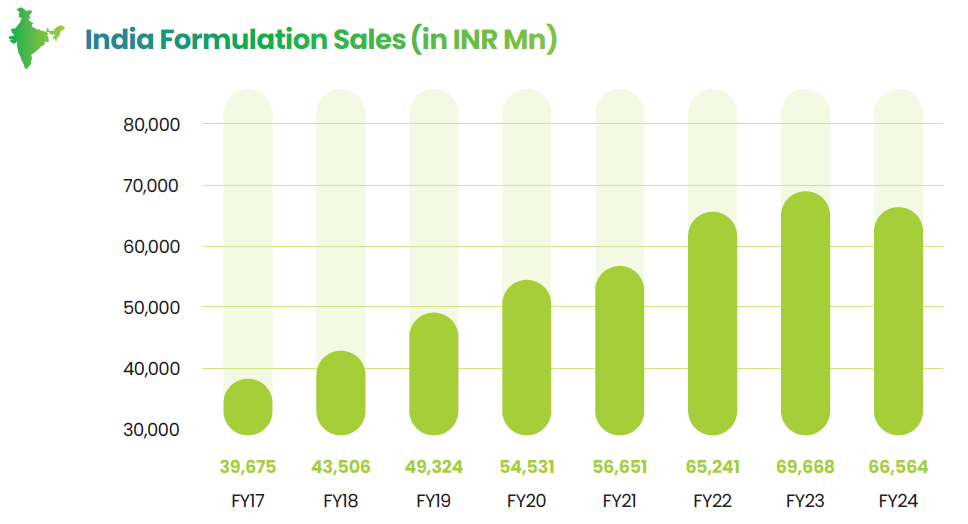

Lupin’s India business has been a strong success story within the Indian Pharma Market (IPM) especially in the chronic and fast growing therapeutic areas. With sales of ₹60,759 Mn, this segment contributes 37% to Lupin’s overall sales, driving high profitability and creating substantial sustainable value for the company. Having a portfolio of high-quality and affordable drugs, coupled with a robust customer engagement strategy, Lupin is the preferred partner for medical practitioners across India. The company’s achievements are exemplified by its sixth rank in the Indian Pharmaceutical Market (IPM) as of MAT March 2023. Notably, Lupin’s branded generics sales witnessed 6.5% increase in FY23, attaining a five-year compound annual growth rate (CAGR) of 10.4%, surpassing the market CAGR of 9.9%. These results have propelled Lupin’s market share to 3.45% in FY23.

Lupin’s India Region Formulations (IRF) business has firmly established its dominance in the pharmaceutical landscape, with the chronic segment serving as its primary sales driver. Notably, Lupin holds the fifth position in the highly promising and rapidly expanding chronic segment. Lupin has an industry leading PCPM of ₹7.3 lakhs. The company’s success is further magnified by its focus on the top five therapy areas in India, namely Cardiology, Anti-diabetes, Respiratory, Gastrointestinal, and Anti-infectives, which collectively account for 73% of Lupin’s sales. Leveraging its expertise, Lupin has consistently been the leader in the Anti-TB segment, holding a steadfast second position in the overall Respiratory segment, and the third position in the Anti-diabetes and Cardiology segments each.

The Anti-diabetes and Cardiology therapies, valued at nearly ₹1,500 crore each for Lupin, exemplify Lupin’s substantial presence in these crucial therapeutic areas. Moreover, Lupin’s Respiratory therapy has crossed the milestone of ₹1,000 crore, while its Gastro+Hepato therapy has surpassed the benchmark of ₹600 crore in sales in FY23. Similarly, in the Cardiac Segment, Lupin recorded a growth rate of 7.1%, compared to a market growth rate of 8.7%. Additionally, in the Respiratory segment, Lupin achieved a growth rate of 8.1%, surpassing the market growth rate of 7%. These results firmly position Lupin as a major player in the industry, poised for continued success and expansion in the years to come.

Lupin’s unwavering commitment to fostering stronger connections with medical practitioners and driving better patient outcomes is evident through its proactive initiatives. In line with this commitment, the company has strategically expanded its field force and undertaken portfolio optimization across multiple therapeutic divisions. Notably, in FY23, Lupin introduced six new divisions within the India Region Formulations (IRF) segment, reinforcing its dedication to key areas of healthcare with an addition of more than 1,000 personnel on the ground which brings our sales force to over 9,100. These divisions specifically target Diabetes care,

Cardiovascular diseases, Respiratory ailments, Gastrointestinal disorders, and Gynecological conditions. They also notably include an extra-urban division, where we will go to doctors in geographies that we don’t cover at this point. By establishing a focused approach in these critical therapeutic areas, Lupin aims to provide enhanced support to healthcare professionals, ensuring they have access to a comprehensive portfolio of innovative and effective solutions. This strategic expansion further underscores Lupin’s proactive stance in addressing pressing medical needs, ultimately leading to a higher standard of care and improved patient outcomes.

Lupin’s commitment to leveraging digital and technology-based solutions to support patients extends to enhancing customer engagement, creating disease awareness, and promoting therapy adherence. Some notable initiatives include:

Lupin has developed exclusive digital assets such as LegalRx to assist physicians with their medico-legal issues, SciFlix for knowledge upgradation of young PG Pulmonologists, and multiple webinars and eCMEs to facilitate Doctor training and development. LegalRx helps physicians with the medico-legal issues and is very well accepted by doctors. There are 50,000+ downloads to date and a high engagement rate. There are over 1,750 doctors onboarded on SciFlix.

Lupin possesses a number of innovative assets, such as ANYA (an AI powered health chatbot) which is now available in 5 languages, across six therapeutic areas including diabetes, heart diseases, respiratory diseases, urology, tuberculosis and the newly launched women’s health category. Anya has received an overwhelming response with over 3.1 Mn queries to date. By taking a holistic approach, we aim to continue to build a digital eco-system that improves patient health outcomes.

Lupin’s strong presence in social media is evidenced by the 56% growth in its Lupin India digital platform and 26% growth in its Shaping Health platform in terms of followers. A sales force nudge tool, SmartRep has been launched across 21 divisions. It will also integrate training videos, call notes, etc. to increase engagement.

LupinLife Consumer Healthcare, our OTC business, has been experiencing consistent growth driven by a well-positioned brand portfolio, effective marketing strategies, and strong retail presence. Since its inception in 2017 with just one brand, the business has evolved into a business with multiple brands and has achieved double-digit growth year after year. Despite the challenges posed by the pandemic, the OTC business recorded a healthy growth rate of 18% for the last 4 years. Our strategic focus revolves around building consumer relevance, enabling agile execution, and demonstrating operational excellence. Some of our top OTC products include:

Lupin prioritizes patient-centricity as the cornerstone of its healthcare strategy. The Company has strategically diversified into adjacent verticals to offer comprehensive solutions. While maintaining steadfast focus in our core prescription pharmaceutical space, Lupin recognizes the critical importance of doctor-patient relationships.. By judicially investing in these ventures, Lupin successfully capitalizes on substantial growth opportunities, positioning itself as a formidable force within the industry as a broader healthcare provider. With an unwavering dedication to patient-centricity, Lupin pursues innovation to generate positive transformation in healthcare outcomes.

Lupin Diagnostics began its operations with the launch of the National Reference Laboratory (NRL) in New Mumbai on December 10, 2021. Since then, it has expanded to 23 processing laboratories across different regions of India, including Hospital Lab Management/Retail Lab Management (HLMs/RLMs) in the West and East zones, and five Regional Reference Labs (RRLs) in Kolkata, Guwahati, Patna, Indore, Hyderabad and Bangalore. Additionally, Lupin Diagnostics has opened a Satellite Lab in Raipur and a HLM in Mumbai.

In FY23, Lupin Diagnostics proudly served more than 300,000 patients. Diagnostic tests have become a crucial component of evidence-based treatment, with approximately 70% of treatment decisions in India being based on diagnostic results. Lupin Diagnostics ensures the accuracy of its results by following stringent quality control protocols and consistently monitoring performance against international benchmarks.

We have received final NABL accreditation for our satellite laboratories in Pune and Nashik, regional reference laboratory in Kolkata, and hospital-linked laboratories at Burdwan and Bankura. Additionally, the assessment of our National Reference Laboratory is under final review with NABL. The accreditation of our labs in Mumbai (Andheri), Nagpur, Guwahati, Dhanbad and other cities including Latur, Satara, Solapur and Varad are in the pipeline.

To enhance accessibility, Lupin Diagnostics has established over 400 collection centers, including company-owned centers and franchise-owned centers called LupiMitra.

Recognizing the increased demand for home health services in the post-COVID era, the company has built a strong home collection service team and network in all the cities where it operates. Patients can easily book home visits and track their assigned phlebotomist’s location and rating through a convenient online platform.

Lupin Diagnostics has focused on brand awareness and patient engagement through retail and digital marketing strategies. Digital marketing campaigns on platforms such as Google, Facebook, and Instagram have reached more than 60 Mn impressions throughout the FY23. The introduction of a Loyalty Card has been well-received by patients and clients, with over 30,000 repeat patients benefiting from the card in the third and fourth quarters of the fiscal year. Retail marketing efforts have included conducting more than 4,800 camps in our Labs and LupiMitra network, and offering free screening for common ailments like diabetes, thyroid disorders, cholesterol, and anemia to over 64,000 patients in residential societies and parks. Lupin Diagnostics has also engaged healthcare professionals through 60+ Continued Medical Education (CME) sessions and Regional Training Meetings (RTMs) to emphasize the increasing role of pathology in overall healthcare management.

Value-added services provided by Lupin Diagnostics include dynamic smart reports for patients, which offer tips for monitoring their health, as well as historical trends for effective treatment of chronic diseases. Recognizing that pre-analytical errors account for the majority of lab errors, the company has placed a strong emphasis on temperature-controlled sample movement, and its 100+ field executives consistently ensure the integrity and quality of each sample.

Lupin Digital Health, established in 2021, plays a crucial role in Lupin’s venture into digital healthcare. Its primary focus is to provide a Digital Therapeutics (DTx) platform to doctors and patients across various therapies. To support its ambitions, Lupin Digital Health has established a Tech, Product & Data hub in Bengaluru and a 24x7 Nerve Centre in Mumbai, aimed at building and operating a world-class digital healthcare product. The team comprises talented individuals from leading organizations in the digital and healthcare domains. Currently, Lupin Digital Health operates in 14 cities in India and has plans to expand its presence to the top 100 cities and towns by the end of 2023.

In FY23, Lupin Digital Health introduced “Lyfe,” India’s first evidence-based holistic heart care program. Lyfe is designed to significantly reduce the risk of heart attacks and improve the vitals and quality of life for cardiac patients. It provides an end-to-end solution for cardiac patients, encouraging adherence to protocols established by their treating cardiologists. Lyfe integrates the power of artificial intelligence (AI) and machine learning (ML) with FDA or CE-approved connected devices, a user-friendly app interface, and dedicated experts to mitigate risks for cardiac patients.

By launching LYFE, Lupin Digital Health aims to alleviate the burden of cardiovascular diseases in India, which is the leading cause of deaths in the country. The goal is to extend the continuum of care beyond hospitals and offer smart solutions for remote monitoring and behavioral modification, ultimately enhancing patient outcomes.

Furthermore, Lupin Digital Health conducted a groundbreaking study in India that demonstrated the efficacy of digital therapeutics among patients with acute coronary syndrome (ACS) and post-percutaneous coronary interventions (PCI). The study, conducted in March 2023 (during the 90-day interim analysis), revealed positive results, with 90% of patients adhering to recommended medication, diet, and exercise regimens. Additionally, 83.3% of patients maintained normal vital signs, and there were no re-hospitalizations within the first 30 days of enrollment.

In the coming years, Lupin Digital Health aims to positively impact the lives of many thousands of patients across multiple therapy areas and solidify its position as one of India’s leading health tech companies.

Atharv Ability, Lupin’s Neurological Rehabilitation Center, was inaugurated on the International Day of Persons with Disability in Mumbai’s Bandra Kurla Complex. It serves as a cutting-edge outpatient facility for adults and children, specializing in neurological rehabilitation. The center offers comprehensive rehabilitation programs based on best clinical practices and utilizes state-of-the-art equipment. A team of qualified neurorehabilitation experts deliver quality care, making Atharv Ability a unique and all-encompassing rehabilitation destination.

Neurological disorders account for the highest percentage of total Disability Adjusted Life Years DALY*(6.3%) as compared to other diseases like Respiratory, HIV and TB, globally. While In India it is 10%, one Indian suffers a stroke every 40 seconds and 60% of stroke cases in India lead to disability. Neuro disabilities can range from paralysis or problems controlling movement (motor control), problems using or understanding language (aphasia), swallowing disorders (dysphagia), and problems with thinking and memory (cognition). Patients with such disabilities need a multidisciplinary rehabilitation program to help them resume their functional and cognitive abilities.

In India, there is a significant gap both for trained neuro physiotherapists and well-equipped rehabilitation centers. Atharv Ability aims to address this gap by providing rehabilitation programs for post-stroke patients, patients with traumatic brain injury, spinal cord injury, and pediatric neurological conditions as well as for other neurological conditions including Parkinson’s, cerebral palsy, and multiple sclerosis and pediatric neurological conditions. The center offers all these treatments under one roof, including neuro physiotherapy, advanced robotics therapy, speech and language therapy, occupational therapy, cognitive therapy, aqua therapy, pain management, spine rehabilitation, activities of daily living training, and pediatric neurological rehabilitation.

Since its launch, Atharv Ability has treated over 1,000 patients and conducted more than 3,000 multidisciplinary treatment sessions in just four months. Patients have experienced remarkable progress, with many who were previously wheelchair-bound regaining their independence. Post-stroke and post-TBI patients have successfully walked out of Atharv Ability with restored confidence and dignity. The pediatric section of the center provides specialized attention, empathy, care, and customized treatment programs for children with conditions like cerebral palsy and developmental delays.

The vision of Atharv Ability is to provide accessible, affordable, and world-class rehabilitation treatment programs to every patient with a neurological disability, ensuring they regain their abilities and reintegrate into society.

Lupin’s India business has a very positive outlook and is well poised to achieve sustainable growth. The company is actively working on various initiatives to enhance its performance. These efforts include focusing on business imperatives, process improvement, and engaging with stakeholders such as doctors, patients, distribution channels, and consumers.

By leveraging its brand-building capabilities, enhanced manpower and robust portfolio of products, and by targeting depth into specific therapeutic segments, the company is well-positioned to achieve new milestones and contribute to a brighter future.

According to the latest Global Use of Medicines report by IQVIA, patent expirations in the U.S. are projected to reach nearly $109 Bn by 2026. Of this amount, biosimilars are expected to contribute $35 Bn as market dynamics mature and major products face genericization.

During FY23, as the pandemic receded, we continued to provide high-quality products to our valued customers and patients across the United States. Thus, maintaining our 3rd ranking in prescription volume, our products accounted for 5.88% of the total generic prescriptions dispensed and 4.7% on total prescrption in the U.S. on an extended unit basis. And hence has been a key contributor to the $373 Bn savings to the U.S. government. Lupin’s portfolio sees decline in average list price for all its marketed drugs each year, reflecting its commitment to provide affordable and accessible medicines to the U.S. patients. (Source: https://accessiblemeds.org/sites/default/files/2022-09/AAM-2022-Generic-Biosimilar-Medicines-Savings-Report.pdf)

Notably, U.S. sales significantly contributed `54,173 Mn to the company’s sales, representing a substantial 33% of our overall sales. Driving this performance were key products such as Albuterol, Lisinopril, Arformoterol, Suprep and Gavilyte. In FY23 we launched 9 products featuring notable introductions such as AG Cyclosporin (May 2022), Gx Suprep (September 2022), Gx Performomist (November 2022), and Gx Pennsaid (December 2022). Lupin achieved higher margins in the U.S. for the third consecutive quarter by optimizing our portfolio, focusing on high value products and reducing costs. We also improved our margins even as we increased our R&D spending quarter on QoQ.

Our flagship inhalation product Albuterol, has maintained a 17% share of the total market for Albuterol (or 20.4% of the generic-only market) and increasing post March-23 quarter. Lupin also continues its leadership in other legacy oral solids like lisinopril, levothyroxine and supported by its class leading and differentiated manufacturing capabilities.

After receiving approval of generic Spiriva recently, Lupin is poised to launch this first time generic in U.S.. This is the first generic inhalation Dry Powder Inhalation drug-device combination that will get launched from India and will be a large contributor to savings for U.S. government drug spending for the future.

In FY23, we strategically expanded our Specialty business portfolio by incorporating two inhalation products, Xopenex® and Brovana®, into our offerings. These products were acquired from Sunovion in October 2022, marking a significant milestone for Lupin. The addition of Xopenex® and Brovana® strengthens our respiratory portfolio, enabling us to provide advanced treatment options for patients with respiratory conditions. This strategic acquisition reinforces our commitment to delivering innovative solutions and further establishes Lupin as a key player in the Inhalation Specialty segment.

Lupin has built a strong market position for Brovana and its generic Arformoterol, reaching a combined share of 48% in Q4 FY23. However, we observed a trend of more prescriptions moving from the brand product to the generic product in each quarter, indicating a preference for lower-cost alternatives.

Furthermore, we solidified and reinforced our Specialty Women’s Health business through our partnership with Exeltis in the promotion of our flagship product, Solosec®. This collaborative alliance is instrumental in our mission to broaden the reach of Solosec® and raise awareness among Healthcare Providers regarding its remarkable benefits in the treatment of Bacterial Vaginosis in women and Trichomoniasis patients.

With oral solid dosage forms continuing to be under pressure due to heightened competition in recent times, the company continues to pivot towards more complex products with a larger spend on research for respiratory and complex injectables. Lupin has taken several measures in recent times to optimise on its portfolio and address inefficiencies and stem any value erosion in the system. Lupin continues to focus on building up an impressive line of first to market products for U.S. across the inhalation and complex injectables space that will provide for significant growth and provide significant healthcare budget savings in the coming future.

The pharmaceutical market in Canada is valued at $25 Bn USD, with a growth rate of 2.7%. Lupin’s subsidiary in Canada, Lupin Pharma Canada Ltd., is a specialty brand company with a presence in gastroenterology and women’s health. Lupin also focuses in niche and complex generics and it is the first company with an approval of generic Tiotropium dry powder inhalation in Canada. Since its commercial inception in 2015, Lupin Pharma Canada has demonstrated steady growth and finished the year with sales over $40 Mn CAD.

The pharmaceutical market in Europe, Middle East, and Africa (EMEA) is estimated to be worth $333 Bn, accounting for 25% of the global market. The EMEA region accounts for 10% of Lupin’s sales.

Lupin’s focus on branded generics, biosimilars, and inhalation products presents a noteworthy growth opportunity for expanding its portfolio in the region.

The pharmaceutical market in Europe is $304 Bn, with the Generic (Gx) business accounting for over $62 Bn. With several pharmaceutical brands approaching patent expiration, the European pharmaceutical market is projected to experience significant growth in the coming years. In fact, spending in Europe is expected to increase by $59Bn through 2027, with a focus on generics and biosimilars, and escalating pressures on the value and negotiated prices of novel medicines. (IQVIA Market Prognosis 2023)

Within the Neurology segment in Europe, our flagship product is NaMuscla®, a prescription medication for adults suffering from non-dystrophic myotonic disorders (NDM), a severe and debilitating neuromuscular condition classified as an Orphan disease.

By offering NaMuscla, Lupin not only addresses the unmet needs of patients but also expands its market presence in Europe, while actively exploring opportunities to introduce the product to other regions.

During FY23, Lupin achieved sales of ₹15,514 Mn in its European business. The launch of the inaugural respiratory product in Europe and the expansion of NaMuscla beyond the markets of the UK, Germany, and France have been key drivers of sales growth. Furthermore, we have made significant strides in enhancing our digital engagement with healthcare practitioners, effectively leveraging digital channels for promotional activities.

Our subsidiary in Germany, Hormosan Pharma GmbH, experienced rebound following the challenging years influenced by the pandemic. The business units demonstrated substantial growth, for all focus products in our portfolio, spanning across Neurology, Pain, and Sexual Health. The portfolio consistently outperformed the market’s CAGR.

Additionally, Lupin successfully closed a series of business development deals in FY23, which have laid a solid foundation for future growth. These strategic initiatives further enhance our prospects for continued success in the coming years.

In the United Kingdom, we introduced Luforbec High Strength to complement our existing low strength product. Notably, similar to the low strength formulation, Luforbec High Strength has received independent certification as carbon neutral through carbon offsetting. This achievement positions Luforbec as the first certified carbon neutral pressurized metered-dose inhaler (pMDI) in the UK.

The launch of Luforbec High Strength, combined with its carbon neutral certification, marks a significant advancement for Lupin’s respiratory

product portfolio and aligns with our commitment to sustainability in the UK. This milestone represents a significant step forward in our efforts to provide innovative respiratory solutions while contributing to a greener future.

Also, Lupin’s Pithampur facilities underwent a successful inspection by the UK MHRA, validating our commitment to maintaining the highest quality standards

The pharmaceutical market in South Africa is valued at ZAR 53 Bn. Pharma Dynamics, Lupin’s South African subsidiary registered sales of ZAR 1,364 Mn. The market experienced a 3.48% year-on-year growth, which can be attributed to sustained expansion in key pharmaceutical segments, including Cardiovascular (CVS), Central Nervous System (CNS), and the over-the-counter (OTC) franchise.

However, following the impact of the Covid-19 pandemic, the growth was adversely affected by a decline in sales from the Efferflu C Immune booster due to a continued decrease in the category’s demand. Furthermore, our chronic product portfolio faced challenges due to benchmark pricing pressures imposed by medical aid funding agencies, resulting in downward price trends.

Pharma Dynamics remains committed to complying with the government’s Broad-Based Black Economic Empowerment (BBBEE) policy, which aims to promote economic participation among the black population.

The compliance not only allows them to engage effectively with key industry stakeholders but also grants them preferred status compared to non-compliant competitors.

In the FY23, Pharma Dynamics secured approvals for 42 products from South African Health Products Regulatory Authority (SAHPRA), and introduced 14 new products to the South African market. Looking ahead to FY24, Pharma Dynamics anticipates sustaining the growth momentum with the planned launch of an additional 14 new products.

Despite the challenges faced, Pharma Dynamics proudly holds the position of the largest Cardiovascular (CVS) company in South Africa, retaining a value share of 14.2%. Their portfolio boasts 20 products currently ranked as top-products in the country, with an additional 21 products in the second position.

In the European market, Lupin has strategic plans in place to expand on the respiratory franchise with the introduction of Luforbec metered dose inhaler (MDI). This expansion will be complemented by continued efforts to grow the presence of NaMuscla®, Moreover, the company remains focused on launching several new products across different therapy segments during FY24.

In addition to our European focus, we are dedicated to expanding our portfolio in the over-the-counter selfhelp (CAMS) category for the South African market. This expansion will allow Pharma Dynamics to tap into new opportunities and meet the evolving needs of consumers in the region.

Data Source: IQVIA MAT February 2023

The APAC region, excluding India, is sized at $251 Bn, representing approximately 20% of the global pharmaceutical market. Lupin’s strategic presence in this dynamic region has been marked by direct presence in Australia and Philippines. Furthermore, our operations in Japan and South Korea are facilitated through trusted local business partners, ensuring effective market access and engagement.

In FY23, the APAC region, accounting for a 6% of overall sales, Lupin outpaced the market’s growth rate of 3.5%. Lupin has delivered robust performance in the region, demonstrating the commitment to innovation, quality, and customer satisfaction.

The pharmaceutical market in the Philippines is valued at USD 4.8 Billion, with a growth rate of 5.2%. Lupin’s subsidiary in the Philippines, Multicare Pharmaceuticals Philippines Inc., is a premium branded generics company with a strong presence in the rheumatology, gastrointestinal, and diabetes segments. Within the reference market, Lupin is ranked second among branded generic companies. Multicare demonstrated strong resilience against the COVID outbreak and ended the year with a total sale of PHP 1,895 Mn, compared to a sales of PHP 1,881 Mn for FY22.

We have a portfolio of over 100 products, covering various therapeutic areas such as anti-infectives, cardiovascular, central nervous system, dermatology, and women’s health. We have a pipeline of new launches planned for FY24 and FY25, including biosimilars and specialty products.

Multicare has been certified as “Best Place to Work” for the second time. This esteemed award underscores the company’s commitment to fostering an exceptional work environment that nurtures employee well-being, growth, and engagement. The “Best Place to Work” recognition also serves as a celebration of the collective efforts of the exceptional team members

Generic Health (GH), Australia is the fourth largest generics player in the region (IQVIA MIDAS MAT Dec 2022). Following the acquisition of Southern Cross Pharma (SCP), a leading hospital generics company, we recorded a consolidated growth of 29% in FY23 to AUD 96 Mn, compared to a sales of AUD 74 Mn for FY22. The Hospital business Integration is now complete where SCP portfolio is being marketed by GH. We have been able to consolidate our warehouses to a single partner, resulting in operational efficiency and cost savings. We have a good basket of 10-15 products that will be launched in next 12 to 18 months, which will further strengthen our position in the market.

Since acquisition, SCP has grown considerably and has started realizing synergy gains. With the acquisition, overall business of GH including SCP now comprises of 60% retail business and 40% B2B business. This gives us a balanced and diversified portfolio across various therapeutic areas and channels. We are also exploring opportunities to expand our presence in other adjacent markets in the region, such as New Zealand.

We are committed to delivering value to our customers and stakeholders in the APAC region by providing high-quality, affordable, and innovative medicines and solutions. We aim to address the unmet medical needs of the region, especially in chronic and specialty segments.

We also strive to enhance our market presence and penetration by leveraging our strong portfolio of products, pipeline of new launches, and strategic partnerships with local players.

Ophthalmic player in Mexico

Player in Brazil in volume

The LATAM region reached sales of $53 Bn in 2022, reflecting a robust growth rate of 10.9%. In FY23, Lupin’s LATAM business demonstrated sustainable growth, with sales growth of 30.1% year on year, contributing 4.7% to overall sales. Among the countries in the LATAM region, Brazil and Mexico stand out as the largest markets, collectively accounting to 70% share. These key markets experienced growth rate of 11% in 2022, underscoring the immense potential and opportunities they offer.

To strengthen our footprint in the region, Lupin has strategically pursued distribution agreements with key players in Chile, Peru, and Colombia. Through this network, Lupin has enhanced presence in these countries, enabling us to better serve local healthcare needs and contribute to the growth of the pharmaceutical industry.

With a size of $12.3 Bn, Mexico stands as the second-largest pharmaceutical market in Latin America. Despite facing macroeconomic challenges driven by the pandemic, the market grew at 12% in 2022. Laboratorios Grin, outpaced the market recording a 13% growth rate. It continues to hold the second position in the ophthalmic market in terms of units sold.

The growth in Laboratorios Grin’s sales can be attributed to its presence in the private Branded channel, which has been supported by a robust innovative pipeline.

By leveraging our global product pipeline, we plan to expand beyond the ophthalmic segment by launching products in the respiratory and CNS segments. We are committed to transforming Lab Grin’s portfolio that would serve across multiple therapy areas.

With a focus on innovation and customer satisfaction, Lupin is well-positioned to further strengthen its position in the Mexican pharmaceutical market and continue driving growth in the coming years.

With a market size of $27 Bn, the Brazilian pharmaceutical industry holds the distinction of being the largest in the Latin American (LATAM) region, contributing to approximately 50% of the region’s sales. In 2022, the Brazilian pharmaceutical market witnessed a growth rate of 13.2%,

MedQuimica, Lupin’s subsidiary in Brazil, has made significant strides in the market and now holds the 10th position in terms of value and the 6th position in terms of volume within the reference market. MedQuimica retains a 2.53% market share, reaching sales of BRL 273 Mn, in FY23, marking a 22% growth, compared to a sales of BRL 224 mn for FY22.

In line with our growth strategy, in FY23, MedQuímica entered acquired nine medicines from BL Indústria Ótica Ltda., a subsidiary of Bausch Health Companies Inc. This strategic acquisition further reinforces our commitment to expanding our product portfolio and catering to the evolving healthcare needs of the Brazilian population.

We are well-positioned to emerge stronger in the coming quarters with our efficient manufacturing platform and an optimal commercial structure

We remain committed to leveraging our expertise, innovative product portfolio, and strong partnerships to continue driving growth and delivering high-quality healthcare solutions to patients throughout the LATAM region. With the LATAM market’s promising trajectory and our expanding presence, we are well-positioned to capture new opportunities and reinforce our commitment to improving health outcomes.

Source: IQVIA Global Midas Sales Audit (Dec 2022); IQVIA Brazil PMB (Jan 2023), Knobloch Mexico MFPM (Jan 2023)

Lupin’s API business operates with a strategic focus, aiming to become a leader in its chosen market segments by building scale and efficiency. Our production expertise and in-house fermentation capabilities uniquely position us to meet the stringent regulatory and quality requirements of global markets. Despite challenges such as cost escalation in the chemical industry due to geopolitical situations, we have effectively managed the impact through strategic product life cycle management and overall efficiency improvements.

The API business in the last three years has been impacted by two major factors—lower demand for cephalasporin products in several parts of the globe and higher cost of PenG from China. But, in FY23 , it saw a returning of growth, increasing revenues by 12% in to reach ₹11,092 Mn, primarily due to the resumption of demand for Cephalosporin products to a certain degree of normalcy. However, the high cost of Penicillin G continues to impact the business profitability. Despite the headwinds, we retained our reach to customers in over 50 countries worldwide, and at the same time, attracting new customers by forging strong partnerships. To drive sustainable business for the future, we are actively adopting greener chemistry technologies, improving efficiency, and protecting the environment. Additionally, we have intensified our focus on commercializing new APIs, resulting in doubling of new product sales compared to the previous year.

Lupin’s extensive experience in fermentation chemistry positions us as a leading producer of fermentation-based anti-TB products and certain anti-infective products globally. Leveraging this core expertise, we are committed to introducing newer products in the coming years, fostering business growth while ensuring the availability of quality drugs at affordable rates.

For many years, Lupin has been dedicated to providing high-quality, affordable, and reliable medicines to underserved communities, enabling a healthy and disease-free life. Our commitment to reducing the burden of tuberculosis (TB), particularly among marginalized populations facing socioeconomic challenges, is deeply rooted in our values.

Lupin has evolved into a comprehensive solution for all anti-TB medications, offering a portfolio that covers first-line drugs for treatment, drugs to combat multi-drug-resistant TB, and drugs for preventing new incidences of TB. We have developed a range of second-line anti-TB medications, including generic versions of newer anti-TB molecules and re-purposed molecules like Bedaquiline, Pretomanid and Delamanid and re-purposed molecules like Clofazimine, Linezolid and Moxifloxacin. With backward integration into key APIs, we can provide these medications at affordable prices without compromising on world-class quality assurance.

Preventing new cases of TB is crucial in achieving the goal of eradicating tuberculosis from the planet. Leveraging our expertise in Rifa-based products, we have developed Rifapentine API, emphasizing our commitment to meeting emerging requirements. We are proud to be among the first companies to commercialize fixed-dose medications of Rifapentine-Isoniazid formulation for preventing new cases of TB. Additionally, we prioritize the development of child-friendly formulations to address pediatric TB. Our pediatric TB portfolio is comprehensive and comprises of all the needed priority drugs for the management of TB in children.

Our TB products reach more than 70 countries across Africa, Latin America, CIS, and Asia, positioning us as a global leader in the first-line management of TB.

In FY23, we made our commercial entry into the antiretroviral (ARV) market, where we anticipate significant market share in access countries. We are enthusiastic about collaborating with international and national public health organizations to provide high-quality and affordable ARV drugs, ensuring uninterrupted supply.

Lupin’s Principle to Principle (P2P) business capitalizes on our expertise in API research and formulation development. This business segment focuses on launching first-to-market products in India and establishing ourselves as a reliable supplier partner. We continuously strive to develop new products, novel formulations, and patient-friendly formulations, which are key drivers of our business growth.

Looking ahead, Lupin’s API PLUS SBU is excited about the future and is well-prepared to pursue new milestones and successes. We are committed to continuous improvement, expansion, and meeting the evolving needs of our customers in the API market.